What is disability insurance?

Disability insurance, also known as income insurance, acts as an income buffer if you’re no longer able to work due to an unexpected occupational disability.

Disabilities covered by insurance have to cause a reduction in your capacity to work by at least 50% and have lasted more than 6 months. The most common disabilities are mental illnesses like burnout or coordination impairments like chronic back pain.

Public health insurance will pay for the first 6 months of an occupational disability, so getting disability insurance can cover the gap until retirement or until you’re able to work again.

How does disability insurance work?

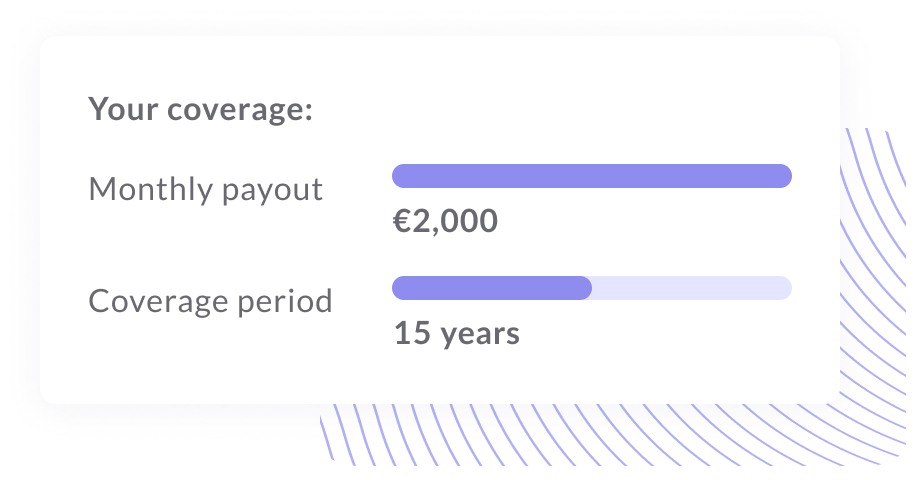

You’ll apply for insurance with a requested monthly payout sum. This is the amount you will get per month after it has been determined that you have an occupational disability.

Why do people need it?

Disability insurance or life insurance?

Disability insurance, or income protection insurance, is a type of policy that will supplement your income should you be unable to work due to an illness or injury. It is designed to help maintain your standard of living during the periods you cannot work due to an occupational disability.

In contrast, life insurance provides a lump sum payment to your beneficiaries when you die. Its purpose is to provide financial support to your loved ones in the event of your untimely death. Life insurance is not designed to replace your income if you become disabled or unable to work due to an illness or injury.

Disabilities related to mental illnesses

Around 1 in 4 people in Germany experience a mental illness each year. Psychological health problems are the second most common reason for sick leave and the most common reason for early retirement. With the mental health add-on, your disability insurance coverage would extend to psychosomatic occupational disabilities.

What’s not covered?

Want to know more?

You can get a personal quote or talk to us to learn more about the plan!

Get a quoteTalk to usWhen you can use income insurance

Chronic back pain

Sam is currently working as a chef but is recently diagnosed with chronic back pain and told by her doctor that because of how physically demanding her job is, she’ll never be able to work in gastronomy again.

She receives her disability insurance after the first 6 months. After that, she decides to go to a 5-month design boot camp and get a new job in another industry. She’ll continue paying her income insurance after her new employment begins.

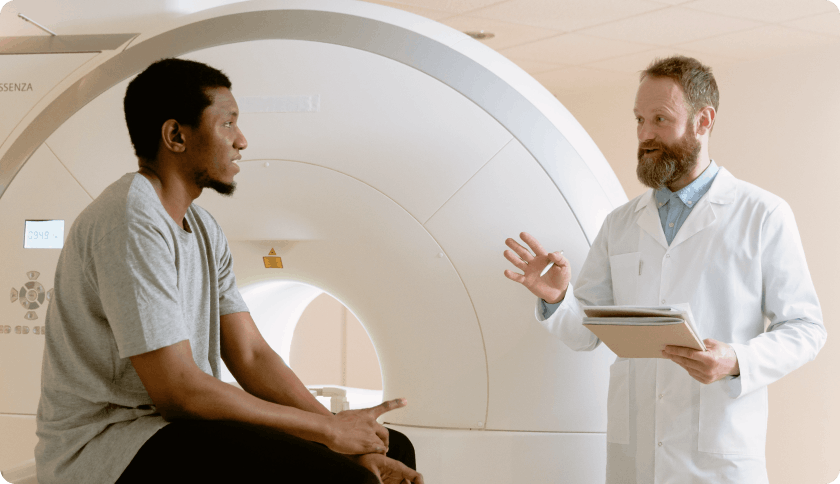

Cancer

Mark is diagnosed with thyroid cancer and needs to have his thyroid completely removed while taking medication and going through therapy to fight off the cancer. After 3 years, he feels well enough to continue his former work and continues to pay into income insurance at that point.

15% of the people who will receive income insurance will have cancer-related occupational disabilities. In this scenario, they will receive their monthly payout until they can work or retire.

Burnout

Mathias took on an internship in his dream industry where he worked upwards of 35 hours per week and studied simultaneously. It was exhausting, but he managed to get a good grade and graduate with a great start-up job.

He begins working upwards of 70 hours per week, while wearing multiple hats to ensure the company is successful. Four years later, the start-up, unfortunately, failed after an established foreign competitor joined the market.

The shock triggered his untreated burnout, and he became completely incapable of working or finding a new job. His doctor diagnosed him with long-term burnout, and now his income insurance is the only source of income.

How much will income insurance provide in compensation?

How are benefits paid out?

Am I eligible?

Can I raise my compensation limit at another time?

What happens if I lose my job and am unable to pay?

Will I be denied income insurance if I smoke?

How can I claim?

What is the difference between a concrete and abstract referral?

Wonder which insurance is best for you?

Try our recommendation tool for free to see which plans match your lifestyle.

Take me there!

Legal

Protection for your legal rights

Personal liability

Protection for damage you cause to people or their belongings

Dental

Comprehensive dental coverage fills public health insurance gaps, offering treatments for preventive care, cleanings and more.

Life

Support for your loved ones in the event of your passing