This post contains affiliate links. It means that if you click on the links and make a purchase, we will receive a small commission at no additional cost to you. This allows our blog to continue providing you with free information. We only include links and products that we truly believe in. You can read the full disclosure here.

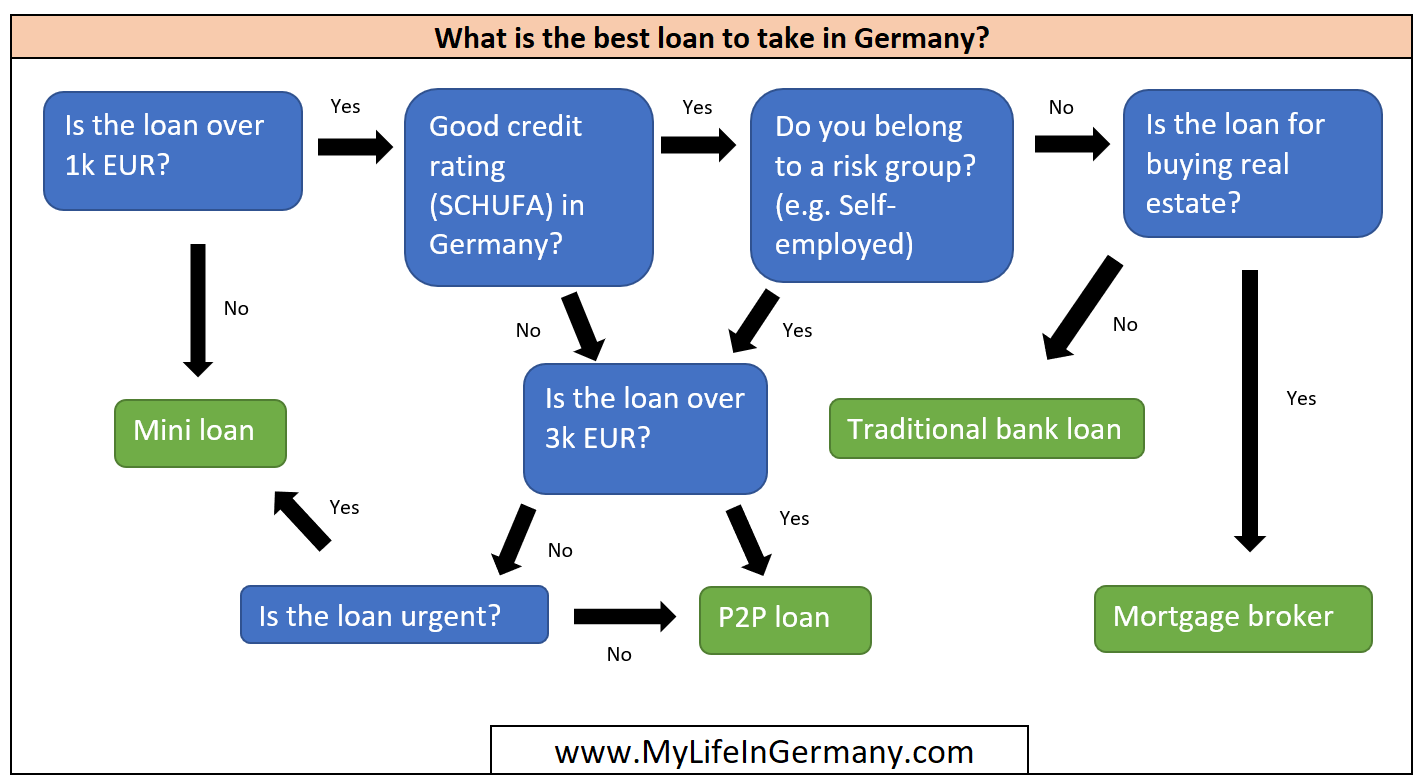

Trying to get a personal loan in Germany? If yes, this article is for you. In this guide, we will talk about the different types of loans in Germany, how to find the best loan offer, and what to look out for when getting a personal loan in Germany.

Table of Contents

ToggleA summary of the different types of loans in Germany

Traditional bank loan: Try this if you

- want to borrow more than 1,000 EUR,

- have a good credit rating (SCHUFA) in Germany,

- and do not belong to a risk group (e.g., self-employed).

| Banks | Loan amount (EUR) | Loan term | Annual interest rate | Some features |

| Santander BestCredit | 1,000 – 75,000 | 1 – 8 years | From 2.99% | • Get your money within a few business days • Possible to pause your credit for 90 days |

| Postbank | 3,000 – 80,000 | 1 – 10 years | From 3.25% | • Fast payout in a few days • Early loan repayment for free |

Mortgage: Try this free online mortgage calculator to estimate if you can get a loan and how much the interest will be. A broker can then compare and explain the best loan offers for you.

Peer-to-peer (P2P) loan: Loan from other private investors. Try this if you are not qualified for a bank loan (no good credit rating or belong to a risk group).

| P2P loan provider | Loan amount (EUR) | Loan term | Annual interest rate | Some features |

| Auxmoney | 1,000 – 50,000 | 1 – 7 years | From about 5.91% | May get money within 24 hours |

Mini loan: A small loan that lasts for 1 to 3 months. Only for small temporary needs until your next salary arrives. You can get this loan even if you don’t have a perfect credit rating in Germany.

| Mini loan providers | Loan amount (EUR) | Loan term | Annual interest rate | Some features |

| Cashper | 100 – 1,500 | 30 – 60 days | Fixed at 13.5% | • Get your loan approved in 60 seconds • 0% interest for new customers |

| Vexcash | 100 – 3,000 | 30 – 90 days | Fixed at 14.82% | • Know immediately if your loan is approved • Can only borrow up to 1,000 EUR if you are a new customer |

Loan comparison tool: Use this to set your criteria and compare different loan offers. Try Tarifcheck or Verivox.

Keep reading for more details about each loan provider in Germany above. Learn about how each type of loan works and which loan will work the best in your case.

Note that the information in the above tables and in the following sections is accurate as of when this article is written. The offers from the loan providers in Germany can change at any time in the future. Please check the websites of the loan providers directly for the latest information.

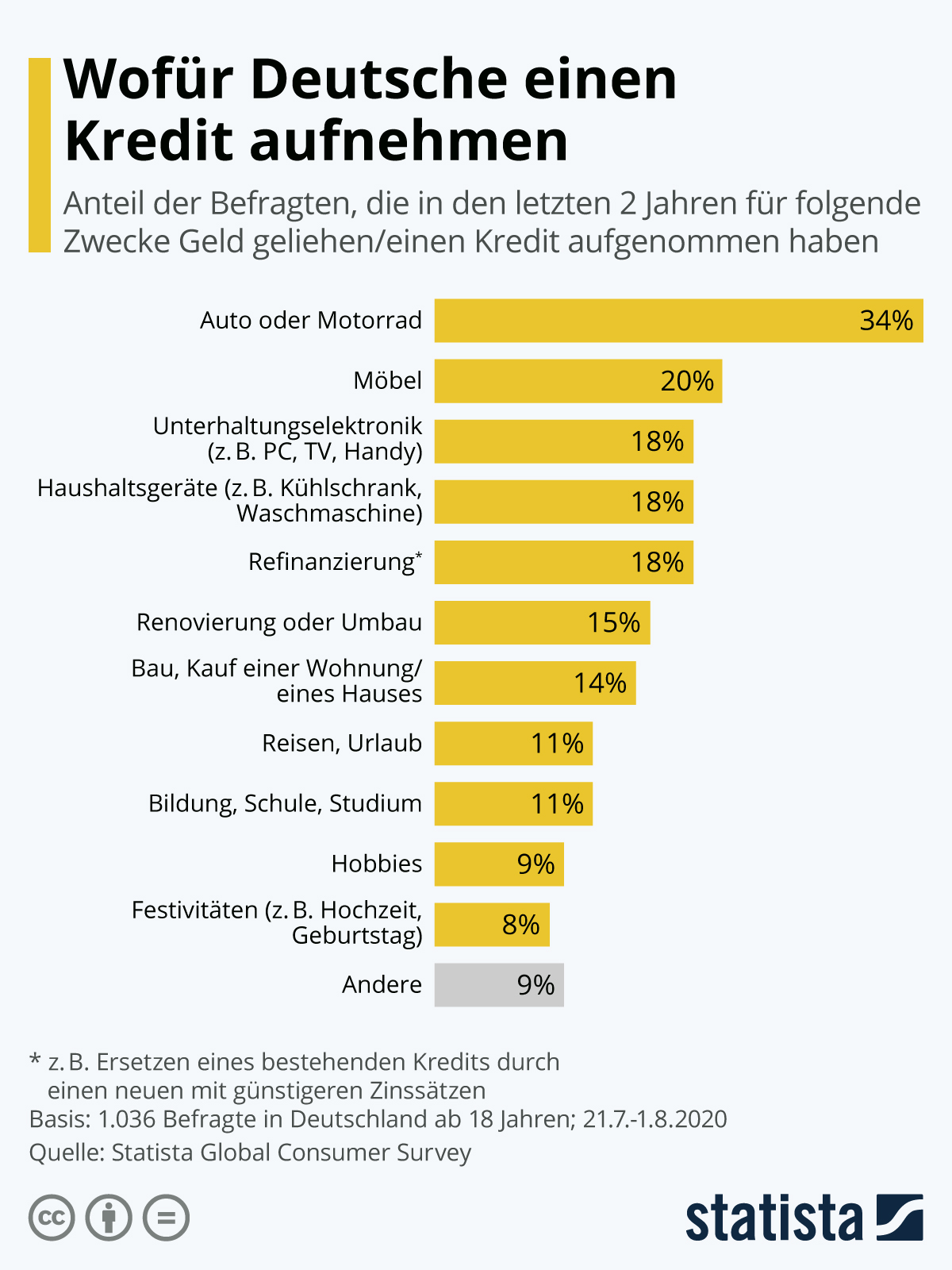

Why do people get a personal loan in Germany?

There are many different reasons why people take out a personal loan in Germany. According to a survey in 2020, the no.1 reason is to buy a car or motorcycle. Other popular reasons include buying furniture, electronic devices, and household appliances.

14% of the people in the survey got a loan to finance their real estate properties. The least common reasons for getting a personal loan in Germany are spending on hobbies or festivals such as birthdays or weddings.

Mehr Infografiken finden Sie bei Statista

Mehr Infografiken finden Sie bei Statista

Can you get a personal loan in Germany as a foreigner?

Foreigners can get a personal loan in Germany. Even though getting a loan in Germany may be more difficult if you are a non-EU citizen, you can still get one as long as you meet the requirements.

What are the requirements to get a personal loan in Germany?

Your age

You need to be at least 18 years old if you want to get a personal loan in Germany.

Your address

To get a loan in Germany, you need to live in Germany. Your address should be registered with the local authority (Bürgeramt or Einwohnermeldeamt).

Your residence permit

Non-EU citizens have a higher chance of getting a loan in Germany if they have a permanent residence permit. It is because banks want to give loans to people who stay in Germany for the long term.

If you have a limited residence permit, it is riskier for the banks to give you a loan in Germany. You may still get a loan if your residence permit covers the whole loan period. The banks may charge you a higher interest rate, though.

A German bank account

You need a German bank account to get a personal loan in Germany. This shouldn’t be a problem if you are already living in Germany.

Check out this post as well for some free/ cheap bank accounts to use in Germany with English services: Opening a Bank Account in Germany – 6 Best Bank Accounts With English Services

Your income

You should have a regular income if you want to get a personal loan in Germany. Your income should be high enough to afford the monthly loan repayment.

To prove that, you will need to show the banks your salary payslips or your bank statement for the last few months. That’s why it can be more challenging for self-employed people or students to get a loan in Germany if they don’t have a stable income.

Read also: Salary in Germany: Are you getting paid enough?

Your employment

If you are employed, you must pass the probation period before getting a loan in Germany. The probation period usually lasts 6 months. It is too risky for the banks to give you a loan because you can be laid off easily during this time.

It is also riskier for the bank if you have a limited work contract. In that case, you can only get a loan with a repayment term within your work contract period.

Your credit score (SCHUFA)

SCHUFA is the credit agency in Germany that collects data and calculate your credit score. If you have a bad credit score, getting a loan in Germany will be more challenging. Most banks will not want to give you a loan. You may still get a loan from other credit institutions at a higher interest rate.

This can be a problem for foreigners as they have not yet built up a good credit score in Germany. For more info regarding SCHUFA and how to improve your credit score, check this out: What is SCHUFA – How to get SCHUFA in Germany?

To apply for a loan in Germany, you also need to show your passport or ID. You can verify your identity by showing your passport to the nearby post office (PostIdent). Or you can use VideoIdent, which allows you to verify your identity with a smartphone or computer at home.

If the bank thinks you are risky, it may ask for additional securities from you. These can be your assets as collateral or a guarantor agreeing to repay your loan if you cannot pay.

Read also:

- Cost of living in Germany – How to save money?

- How to Save Money During a Crisis – 8 Best Tips to Save and Earn

What are the different types of personal loans in Germany?

Here are some common types of loans offered by traditional banks or other financial institutions:

1. Installment loan (Ratenkredit/ Konsumentenkredit)

An installment loan is also called a consumer loan. It is a personal loan without security (no collateral).

Some features of an installment loan:

- Repayment in equal monthly installment

- The most common type of personal loan in Germany

- You can use the loan for any purpose, e.g., my husband bought a new sofa with an installment loan when he moved into a new flat after getting his first job.

- The loan amount is usually up to 50,000 EUR.

- The loan duration is usually between 1 to 10 years.

As security for the bank, your loan contract often states that the bank can get money directly from your employer if you do not repay the loan.

2. Instant credit (Sofortkredit)

Instant credit is a type of installment loan. You can use instant credit for any purpose. The advantage of instant credit is that you can get the loan faster (that’s why it is called “instant”). But the loan amount is usually smaller.

3. Mini loan (Kurzzeitkredit/ Minikredit)

This is also called a payday loan. You can use this loan if you are a little bit short of money until you receive your next salary.

Some features of a mini loan:

- Very short term (usually only 1 to 3 months).

- The loan amount is tiny (usually up to 3,000 EUR).

- Very high interest rate (up to 15%)

- Use it only if you need money urgently

Some best mini loan providers include Vexcash and Cashper.

4. Car loan (Autokredit)

This is another type of installment loan. The difference is that you can only use this loan to buy a car. A car loan is a secured loan. The interest rate of a car loan is lower because the bank can use your car as collateral if you cannot repay the loan.

Read also: How to Buy a Car in Germany and Register It – 7 Easy Steps

5. A credit line (Rahmenkredit)

You can arrange a credit line at a bank, where you can borrow money quickly. First, you will agree with the bank on the sum of the credit amount. You can then take out money any time you want within this credit line.

You do not have to borrow all the money from your credit line. Instead, you can take as much or as little as you want within your credit line. And you only pay interest on the money you borrow at a variable interest rate.

Some features of a credit line:

- A credit line is usually between 2,500 EUR to 25,000 EUR.

- It works similarly like when you overdraft your checking account, but the interest rate is generally lower.

- Very flexible as you can borrow any amount you want within your credit line quickly.

- Pay interest only on the borrowed amount with a variable interest rate.

You can check out here for more details about how a credit line works.

6. Overdraft facility (Dispositionskredit)

If you have a checking account in Germany, your bank may allow you to overdraft your account. This is called overdraft credit. You agree with the bank about the maximum overdraft amount. Then, you can overdraft the account balance as you want with a fixed interest rate.

Some features of an overdraft facility:

- Suitable for a small loan

- Flexible and fast because you can overdraft the balance as you need it without going through a loan application

- The interest rate can be high

- Good if you spend over your budget for that month and just need a little more money until your next salary

Read also: Opening a Bank Account in Germany – 6 Best Bank Accounts With English Services

7. Credit card (Kreditkarte)

A credit card loan works similarly to an overdraft facility. If you have a revolving credit card, you have a credit line to use. You can shop with your credit card or withdraw cash and only pay back the amount at a later time. Usually, you can repay the amount either in whole or in installments. The interest rate is very high if you repay your debt in installments.

Read also: Free Credit Card in Germany – Top 6 For Travel and Cashback

8. Rescheduling loan (Umschuldungskredit)

If you have more than one loan, you may be able to save money by combining them into one bigger loan. The interest rate is usually lower when you combine your loans. Besides, it is easier to track your finances as you only have to pay one loan instead of several.

9. Collateral loan (Lombardkredit)

You can use your funds or stocks in your account as a security for a collateral loan. The amount of the collateral loan is based on the value of your security. You can use the collateral loan for any purpose. If you cannot repay the loan, the bank has the right to take your collateral.

Read also: Best Online Broker Germany – Top 5 Comparison

10. Mortgage (Hypothek/ Immobilienkredit)

You can use a mortgage to finance your real estate in Germany. The bank uses your property as security. So, you can get a big loan with a low interest rate. There are many different types of mortgages in Germany. For example, annuity mortgages, interest-only mortgages, building society mortgages, etc.

It can be pretty confusing for foreigners at the beginning. If you want to learn more, I have written an article about the different types of mortgages and their pros and cons. Check this out here: Mortgage in Germany – English Guide (Plus 6 Best Tips!)

If you want to get a mortgage in Germany, the easiest way is to use this free online mortgage calculator. Just enter the house price, down payment amount, and other basic info. You can then see the different mortgage options in minutes.

Read also:

11. Peer-to-peer loan (P2P Kredite)

This is a loan you can get from other private people. You can get a P2P loan via a P2P platform, which acts like an intermediary between lenders and borrowers.

Some features of a P2P loan:

- You can borrow money from a group of private people instead of a traditional bank

- An excellent opportunity for private lenders to invest their money

- A P2P loan is faster and easier to get with minimal bureaucracy

- You can also get a P2P loan without a good credit score in Germany

How much interest do you need to pay for your personal loan in Germany?

Some common factors that can affect your interest rate:

The purpose of your loan

A secured loan such as a mortgage or a car loan has a lower interest rate than an unsecured loan.

How risky are you?

If you don’t have a good credit rating (SCHUFA) in Germany, it is riskier for the bank to give you a loan. Same if you don’t have a stable income. Your interest rate will then be higher.

The term and the loan amount

A small loan with a very short term can have a very high interest rate. For example, a mini loan or if you borrow money from your credit card.

Who are you borrowing from?

The cheapest would be to get a loan from a traditional bank in Germany. The annual interest rate can be as low as 2%. If you get a P2P loan, the annual interest rate can start from about 4%. Mini loans have the highest annual interest rate (about 8% to 15%).

From where can you get a personal loan in Germany?

Generally, you can get a loan from a bank, a credit institution, or other private people.

1. Loans from a bank

This is the traditional type of loan. You go to your bank and apply for a loan. A traditional bank usually requires more paperwork and only gives loans to people with good credit scores in Germany.

So, if you have just moved to Germany and have not yet built up a good credit score (SCHUFA), it may be harder to get a loan from the bank. But you can still try to ask your bank.

If you have been using your bank for some time, your bank has your record. For example, it knows if you are receiving regular income and your bank balance. If you are lucky, you may still get a loan from your bank even when you don’t have a good SCHUFA score yet.

Besides, if you hold stocks or funds at your bank, you can try to get a collateral loan with these assets as security for the bank.

A bank loan is good if you need to borrow a large sum of money for a more extended period. For example, a mortgage to purchase your house.

2. Loans from other private people

Some peer-to-peer (P2P) platforms act as a middleman between the borrowers and lenders. The lenders are private people who want to invest their money. In this case, you will be getting a P2P loan. P2P platforms are online. It means faster processing and less bureaucracy.

A P2P loan is the easiest because you may even get a loan if you don’t have a good credit rating in Germany. However, the interest rate can be high depending on your situation.

3. Loans from a credit institution

Your credit score in Germany is still important when you apply for a loan at a credit institution. But they are usually less strict compared to traditional banks in Germany.

Applying for a loan at a credit institution is less bureaucratic than a bank. Many credit institutions are online, and the process is usually faster. It is a good option if you want a smaller loan with a shorter repayment term.

How to find the best loan offer in Germany?

There is no one-size-fits-all solution to getting the best loan offer in Germany. The best loan offer for you may not be the best for someone else. It all depends on your need and your unique situation.

When looking for the best loan offer in Germany, ask yourself the following questions:

- Do you have a good credit rating (SCHUFA) in Germany?

- How urgently do you need the loan?

- Do you need a big or small loan?

- What is the purpose of the loan?

You will know where to look for the best loan offer by answering these questions. Let me explain.

1. Traditional bank loans in Germany

Traditional bank loans tend to be the cheapest way to borrow money. You may get a big loan at an annual interest rate below 2%. So, you should go for it if you can. However, traditional banks are more strict. You may want to look for a traditional bank loan in Germany if

- you want to borrow more than 1,000 EUR

- you have a good credit rating in Germany

- you don’t belong to a risk group, e.g., self-employed

If you want to get a mortgage to purchase a real estate property, it is better to use a free broker service. A broker can compare loans from many different banks and explain to you the various options. To start with, you can first try this free online mortgage calculator.

If you are interested in getting a bank loan, here are some best bank loan providers:

Santander BestCredit

Santander was founded more than 60 years ago. It is one of the top 5 banks in Germany in terms of the number of private customers.

Some highlights:

- Fully online and digital application

- Loan amount from 1,000 EUR to 75,000 EUR

- Loan term from 1 to 8 years

- Low interest rate starting from 2.99%

- Fixed interest rate during the loan term

- A low monthly repayment rate

- Fast approval

- Get your money fast (within a few business days)

- Possible to pause your credit for 90 days

Submit a non-binding loan inquiry at Santander now!

Postbank

Postbank is one of the biggest banks in Germany. If you already have a bank account at Postbank, you can apply for a loan there easier and faster.

Some highlights:

- Online application

- Early loan repayment for free

- Loan amounts from 3,000 EUR to 80,000 EUR

- Loan term from 1 to 10 years

- Low interest rate starting from 3.25%

- Fast payment in a few days

Submit a non-binding loan inquiry at Postbank now!

2. P2P loans in Germany

If you cannot meet the requirements to get a bank loan, a P2P loan will be another option. P2P loan has a higher interest rate, starting from about 4% per year. You may want to look for a P2P loan in Germany if

- you are not qualified for a bank loan

- you want to borrow more than 1,000 EUR

If you need a P2P loan in Germany, Auxmoney can be a good choice.

Auxmoney

Auxmoney is a leading peer-to-peer platform for private loans. For people who do not (yet) have a good credit rating (SCHUFA) in Germany, Auxmoney is an excellent choice for a loan.

Unlike traditional banks, Auxmoney does not only look at your SCHUFA score. Instead, it uses other data points to develop its “Auxmoney score” when assessing your risk category.

That is why even if you belong to one of the below categories, you still have a good chance to get a loan at Auxmoney.

- Students

- Housewives

- People with fixed work contracts

- Employees within the probation period

- Self-employed

- Retired

Below are some more highlights about Auxmoney:

- 100% online and digital

- Loan amount from 1,000 EUR to 50,000 EUR

- Less paperwork required compared to traditional banks

- Possible to get your money within 24 hours (or a few business days)

The process is straightforward. You can inquire about a loan (non-binding), answer a few questions, and get approval within minutes!

Submit a non-binding loan inquiry at Auxmoney now!

3. Mini loans in Germany

If you only want to get a small loan for a very short period until you get your next salary, then a mini loan is for you. The mini loan has the highest annual interest rate (about 8% to 15%). However, since you need to repay the loan in 1 to 3 months, and the loan amount is tiny, the interest you have to pay in total can appear very little and affordable.

You may want to look for a mini loan in Germany if

- you want to borrow less than 3,000 EUR

- you only need the loan for 1 to 3 months

- your loan is super urgent

Here are some best mini loan providers:

Cashper

Cashper is a brand from Novum Bank Ltd. It is one of the cheapest mini loan providers in Germany. For example, if you borrow 300 EUR for 30 days, you will only pay 3.13 EUR interest. This is a fixed annual interest rate of 13.5%.

Some highlight:

- Online application without paperwork

- Loan amount from 100 EUR to 1,500 EUR

- Loan period from 30 to 60 days

- Get your loan approved in 60 seconds

- A fixed annual interest rate of 13.5%, regardless of your credit rating

- Your loan request doesn’t affect your SCHUFA score

- Possible to get a loan if you don’t have a good SCHUFA rating

Check out the short-term loan from Cashper now!

Vexcash

Vexcash is one of the leading mini loan providers in Germany. If you borrow 300 EUR from Vexcash for 30 days, you will pay 3.48 EUR interest. This is a fixed annual interest rate of 14.82%. One drawback is that with Vexcash, you can only borrow up to 1,000 EUR if you are a new customer.

Some highlights:

- Online loan application

- Loan amounts from 100 EUR to 3,000 EUR

- Loan term from 30 to 90 days

- Fixed annual interest rate 14.82%

- Possible to get a loan even if your SCHUFA record is not perfect

- Know immediately if your loan is approved

Check out the short-term loan from Vexcash now!

4. Loan comparison tools

If you are unsure which loan is the best, using a comparison tool will be the easiest. With the tool, you can filter your criteria. The tool will then show you all the loan offers that meet your need, and you can compare them easily.

Here are some best loan comparison tools:

Tarifcheck

Tarifcheck is one of the most popular comparison tools that you can use to shop for a loan in Germany. Just enter basic loan information such as the loan amount, the term, and the purpose of the loan. You will then see a range of offers from different loan providers.

Each offer will show the estimated interest rate and monthly repayment amount. You can also click on the offer to see more details on the conditions.

There is also a filter function at Tarifcheck. If you want, you can filter loans that can pay you immediately or a loan that allows you to repay early. You will also find other options, such as the possibility of a pause during the repayment period and loans for self-employed people.

Use Taricheck to compare different loan offers now!

Verivox

Verivox is another large comparison platform in Germany. It works similarly to Tarifcheck. You need to enter the loan amount, the term, and the purpose of the loan to see all the offers. You can also use the filter function if you want something specific.

There are even loans with interest rates starting from 0.0% under certain conditions. Check it out by yourself!

Use Verivox to compare different loan offers now!

Note that the information in the above tables is accurate as of when this article is written. The offers from the loan providers in Germany can change at any time in the future. Please check the websites of the loan providers directly for the latest information.

12 Tips on getting a personal loan in Germany

1. Think about if you really need the loan

Is the loan really necessary? For example, if you want to borrow money to go on a vacation, can you wait until you save enough money instead of getting a loan?

Do you have other sources to get money instead of a loan? For example, do you have friends or family who can help in the short term? Do you have stock or funds that you can sell to access money? Maybe you can ask your employer for a salary advance?

2. Know how much you can afford

For example, before we took out our mortgage, we created an excel spreadsheet. We estimated our cash flow for the next 30 years based on our expected income and expenses.

I know that this is not going to be accurate. And we will have to adjust our spreadsheet as time goes by. But this gives us a good overview and helps us decide how large a monthly repayment amount we can afford.

I suggest you do a similar exercise to make sure you can afford the monthly repayment after taking out a loan. This can help you to avoid any financial problems in the future.

3. Understand your credit rating in Germany

Your credit rating (SCHUFA) score is critical in Germany. It is not only for getting a loan but also for opening a bank account, getting a credit card, signing an internet contract or mobile phone contract, and even finding an apartment in Germany.

So, it is good to know your credit score and try to improve it. You can start by requesting your SCHUFA record. You can order your SCHUFA record for free or get a paid report.

For more details, check this out: What is SCHUFA – How to get SCHUFA in Germany?

4. Apply for the correct type of loan in Germany

Car loans are specific for buying a car. Mortgages are specific for purchasing a property. These loans have a particular purpose. They are secured because your vehicle and house can serve as collateral for the bank. So, their interest rates are lower than an unsecured loan which you can use for any purpose.

5. The borrowing rate vs. the actual interest rate

When you are looking for a loan, you will see that there are 2 different interest rates. One is called the borrowing rate (Sollzins). The other one is called the effective rate (Effektivzins).

The borrowing rate is the interest you must pay the lender. However, besides the interest, there may be other fees involved. The effective rate takes into account also those additional fees. And this is the rate you should pay attention to because it reflects the total cost of getting your loan.

6. How urgently do you need the money?

Applying for a loan at a traditional bank usually takes longer because it requires more paperwork and checks. If you need the money urgently, it is better to look at credit institutions or peer-to-peer platforms. Everything is online, and the processing time can be much shorter (within days).

7. Condition inquiry (Konditionsanfrage) vs. credit inquiry (Kreditanfrage)

If you are making a condition inquiry, you are trying to determine the conditions of a loan, e.g., the term, interest rate, and monthly repayment amount. This is a non-binding inquiry and will not impact your credit score (SCHUFA) in Germany.

A credit inquiry is something different. In this case, you are applying for a loan from a specific provider. The loan provider will check your credit score from SCHUFA, and this inquiry will stay in the record. So, making several credit inquiries can hurt your credit score in Germany.

When shopping around and comparing different loans in Germany, you should only make a condition inquiry instead of a credit inquiry. If you are unsure, look for the word “SCHUFA neutral“. It means that the inquiry will not affect your SCHUFA score.

If you have decided to apply for a loan by submitting a credit inquiry, do not submit more than one at the same time. This will reduce the risk of impacting your SCHUFA score negatively.

8. Apply for a loan in Germany together with someone else

For example, I got my mortgage together with my husband. Since we both work and have income, we got a good mortgage deal. Similarly, suppose you apply for a loan with another person (not necessarily your spouse). In that case, you will have a higher chance of getting the loan and have a lower interest rate. It is less risky for the bank as two people are responsible for paying back the loan.

9. Understand the terms and conditions

Before you sign any contract, you should read and understand the terms and conditions. Are there any other costs associated with the loan contract? Can you repay the loan earlier? If yes, do you need to pay a penalty fee? And how much?

10. Deciding on the terms of the loan

When you decide on the terms of the loan, don’t just look at the monthly repayment rate. It is true that you have to pay less every month if the term is longer. But you will also have much more interest expenses if you have a longer term.

So, you need to find the right balance. You should assess when is the earliest possible date you can repay the loan. Avoid long-term loans if that is not necessary. Remember that you may need to pay a penalty fee if you want to repay a loan sooner.

11. Compare different loan offers

Always compare different loan offers before you decide on the best one. The terms and conditions can be very different depending on the loan providers.

As mentioned before, make sure you make a condition inquiry (Konditionsanfrage) instead of a credit inquiry (Kreditanfrage). Otherwise, it may affect your credit score in Germany negatively.

12. Know your right as a loan borrower in Germany

According to the consumer advice center, you have the right to cancel the loan contract within 14 days after you have signed it. Besides, you have the right to repay your loan earlier than the agreed schedule. You may have to pay a penalty fee for early repayment, though. The penalty amount should be up to 1% of your early repayment.

For more details, check out this page from the consumer advice center.

Conclusion

Now, you know about the different types of loans in Germany and how you can find the best offer depending on your need. Assess your financial situation and choose your loan carefully! Getting a loan in Germany is a financial commitment, and you should know what you are doing before you get one.

Good luck with your loan application!

Important vocabulary when getting a personal loan in Germany

Different types of personal loans in Germany

German | English |

Ratenkredit/ Konsumentenkredit | Installment loan |

Sofortkredit | Instant credit |

Kurzzeitkredit/ Minikredit | Short-term credit/ mini loan |

Autokredit | Car loan |

Rahmenkredit | A credit line |

Dispositionskredit | Overdraft facility |

Kreditkarte | Credit card |

Umschuldungskredit | Rescheduling loan |

Lombardkredit | Collateral loan |

Hypothek/ Immobilienkredit | Mortgage |

P2P Kredite | Peer-to-peer loan |

Applying for a personal loan in Germany

German | English |

Darlehen | Loan |

Nettokreditbetrag | Net loan amount |

Kreditlaufzeit | Loan term |

Verwendung | (Loan) purpose |

Monatsrate | Monthly installment |

Zinsen | Interest rate |

Sollzins | Borrowing rate (interest rate without additional fees) |

Effektivzins | Effective rate (interest rate plus additional fees) |

Gesamtkreditbetrag | Total credit amount |

Auszahlung | (Loan) payout |

Tilgung | (Loan) repayment |

Sondertilgung | Unscheduled repayment |

Konditionsanfrage | Condition inquiry (not affecting your SCHUFA score) |

Kreditanfrage | Credit inquiry (affecting your SCHUFA score) |

Bonität | Credit rating |

SCHUFA | Credit agency in Germany |

Pin it for later:

Disclaimer

Please be aware that this article is for information only for those who are looking for a loan in Germany. I am not a financial adviser, and this article does not represent professional advice. Before getting a loan, you should read the loan contract’s fine print to ensure you understand the details.

We picked the loan providers in Germany based on our personal experience, online review, and in-depth research. We do not provide a complete market overview.

Note that the data in this article is accurate as of the date when this article is written and is subject to change any time in the future. Our blog makes no guarantee as to the accuracy or timeliness of the information in this article. And we do not accept any form of liability resulting from reading this article. Please refer to the loan providers’ websites if you need more details or the latest information.

Do you have a personal loan in Germany? What kind of loan do you have? Leave a comment below and share your experience!

Moving to Germany or new in Germany? Check out our Resources Page for all the help you need!

If you found this article helpful, consider supporting this website by buying me a coffee. Every small donation helps to keep this blog alive. You can also ask me any questions here. Buy me a coffee