This post contains affiliate links. It means that if you click on the links and make a purchase, we will receive a small commission at no additional cost to you. This allows our blog to continue providing you with free information. We only include links and products that we truly believe in. You can read the full disclosure here.

Are you planning to move to Germany and wondering how much money you would need? In this article, you can have an overview of the cost of living in Germany, as well as the different ways to save money while living in Germany.

Moving to Germany or new in Germany? Check out our Resources Page for all the help you need!

Introduction

Nowadays many people move to Germany because of its strong economy and great job opportunities. Students also like to move to Germany to take advantage of the high quality of the universities and the free tuition fee.

If you are planning to move to Germany, it would be good to have some ideas about the cost of living in Germany beforehand. Germany is relatively inexpensive comparing to most of the popular English speaking countries like the US, UK, etc. Within Europe, Germany is also cheaper than countries like Switzerland, Luxemburg or the Scandinavian countries. Germany has, however, a higher cost of living comparing to the eastern European countries.

Read more: 20 Ideas to Make Money from Home that anyone can do

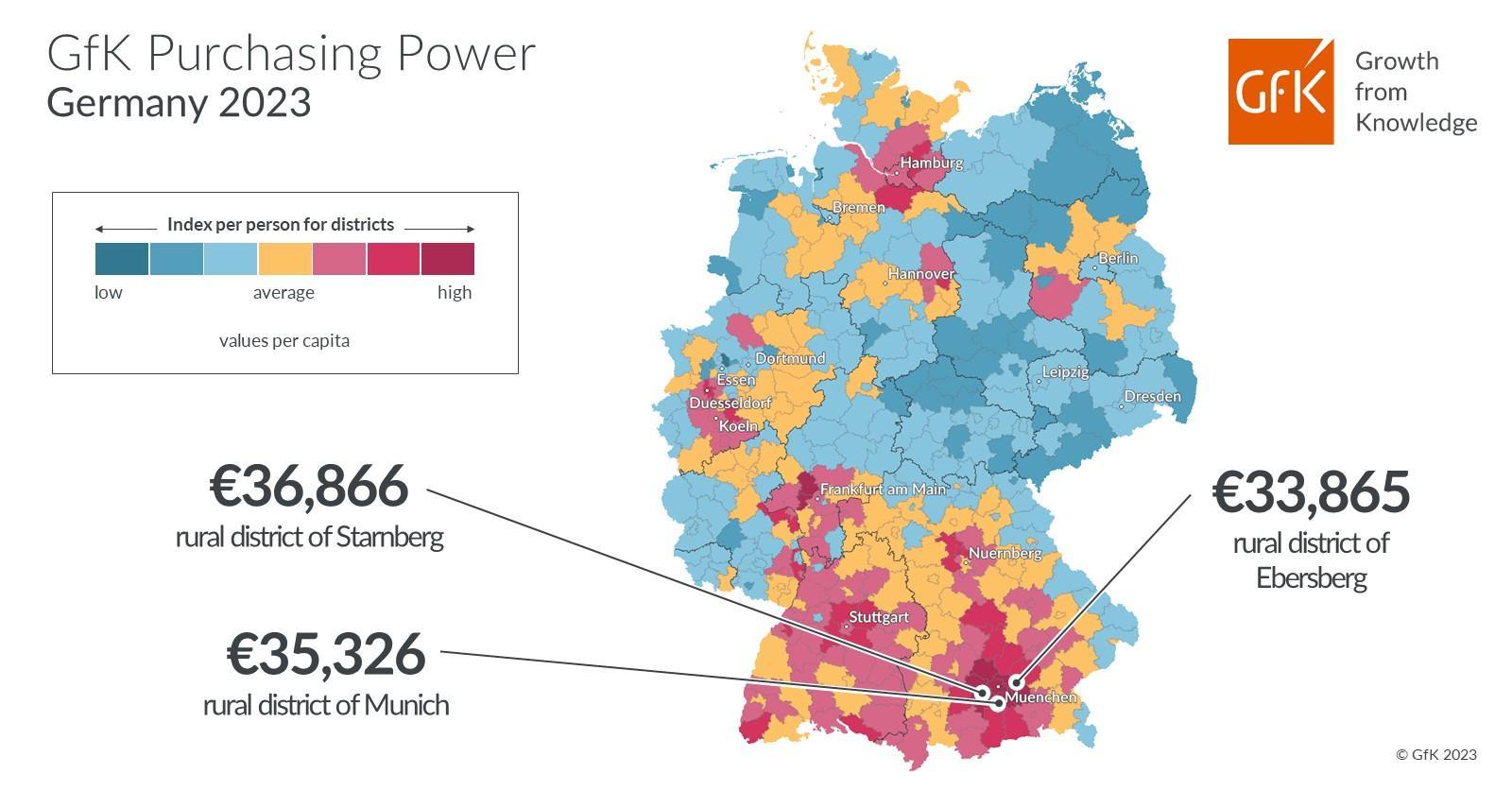

Cost of living varies in different cities of Germany

Within Germany, the cost of living can also be quite different depending on the city you live in. In general, the cost of living in the southern part of Germany is higher and the eastern part of Germany is usually cheaper. For example, Munich is one of the most expensive cities in Germany, while Berlin has a relatively low cost of living despite being a big city. The picture below can give you some ideas about the level of living costs in the different parts of Germany.

If you are single and look into ways to save money while living in Germany, you can probably survive with around 860 EUR per month in Germany. When I was a student in Berlin, I spent even less than that because Berlin has a low cost of living and I was living in a very cheap student dormitory. But of course, how much budget you need in Germany depends on your city and how expensive your lifestyle is. So, it is really subjective.

Bear in mind that cities with a higher cost of living in Germany have usually also more employment opportunities and a higher salary level. Check this post to see how much salary you should earn in Germany. In my opinion, it is great to study in a German city with a lower cost of living (like Berlin), then work in another city with a higher salary level (like Munich).

Let’s look at some major costs you will need to consider if you plan to move to Germany.

Read also: How to Save Money During a Crisis – 8 Best Tips to Save and Earn

Cost of living: Bank expenses for expats in Germany

Opening a bank account will be one of the first things that you have to do when you move to Germany. You can read here for a comparison of all the English banking options in Germany.

When you move to Germany, you may need to transfer a large sum of amount to your German bank account at the beginning to support your cost of living in Germany. If you are from a non-EU country, you will likely need to open a blocked bank account in Germany. This is one of the requirements to obtain your visa. For more details, check this out: Best Blocked Bank Account in Germany – Compare the Top 3

Even if your bank tells you that they don’t charge you any fee to convert your home currency to EUR, the bank is taking advantage of you by using a bad exchange rate in the conversion. It means that the more money you transfer, the more costly it is for you.

And if you are from Asia like me, you may need to support your family back home financially while living in Germany. In my case, my parents in Hong Kong rely on my financial support for their retirement life. It means that I am sending money to them regularly to make sure they have what they need. Doing a bank transfer can be very costly due to the bank fees and bad exchange rates.

How to save money?

Using a bank to make an international money transfer with different currencies is probably the worst thing you can do. I used to do it for the first few years after I moved to Germany until I heard about the services from CurrencyFair. I would have saved so much money if I knew it before!

I used to pay more than 30 EUR fee to transfer money to Hong Kong with banks. With CurrencyFair, the fee is only 3 EUR no matter how much I exchange. The exchange rate it uses is also much cheaper than the one used by the bank. Besides, I can also set a higher exchange rate and the transfer will only take place once this rate is reached.

By the way, Currencyfair is also offering 10 free transfers to our readers at the moment if you want to try it out for free.

Cost of living: University cost in Germany

Studying at a German university is a good option if you plan to work and live in Germany afterward. Below are two types of expenses you may need to pay to the universities.

Tuition fees

Most public universities do not charge tuition fees, not even to non-EU students. (Very cool, right?) That is also one of the reasons why I chose to study for my master’s degree in Germany. I have heard that some states have changed now and may charge tuition fees to non-EU students. But the majority should still be free. However, if you study in a private university, the tuition fee can be more than 10k EUR per semester, depending on the universities.

Semester contribution

Apart from the tuition fee, you will need to pay a fixed amount of money to the university every semester called semester contribution. The amount is different depending on the universities and is between 100 EUR to 350 EUR per semester on average. The semester contribution covers administrative expenses which include also services for the students like cafeterias, sports facilities, etc. Sometimes the semester contribution fee also includes a semester ticket which is a public transport pass. With this pass, you can use public transportation in the city for six months for free.

How to save money?

When choosing your university in Germany, check the cost of living in that city. Especially if you have a tight budget, it may be wise to study in a German city where the cost of living is lower, since you may not have much income to support your living when you are a student. For example, I chose to study in Berlin as the cost of living was very low back then.

You can also try to find some student jobs to support your living. Check this out: 9 ways to earn money in Germany as a student.

Cost of living: Health insurance in Germany

Germany has a very good healthcare system. If you come to study or work in Germany, you must have a health insurance. Health insurance is compulsory in Germany regardless of your residence status. You will need to have a health insurance when applying for a visa.

I actually find it very good that health insurance is compulsory in Germany because people can just visit doctors when they need it, without worrying too much about the costs.

There are two types of health insurance: public or private. For public insurance, you will pay significantly less (around 112 EUR – 125 EUR per month) if you are a student who is under 30 years old and have not finished your 14th semester. Afterward, the price will be between 231 to 513 EUR per month, depending on your income. The higher your income, the more you have to pay. Note also that if you are employed, your employer will cover half of your contributions. If you are self-employed, you will have to pay the whole amount yourself.

We recommend using TK if you are looking for public health insurance (Check my TK review here). You can sign up your TK public insurance 100% in English using Feather.

If you have private health insurance, the price will depend on the insurance companies and on the coverage you choose. We recommend using Ottonova for expats because of its excellent English support.

For more details, check out also this post: Private vs Public Health Insurance: What is Better for Expats in Germany?

How to save money?

If you prefer to get professional advice before buying your insurance, I can highly recommend joining a free English online seminar. The seminar is hosted by financial advisers from Swiss Life Select, one of the largest German financial advisory companies.

By the way, we bought all our insurances via our financial adviser from Swiss Life Select. Our financial adviser does not work for a specific insurance company. Instead, he compares the best offers in the market and gives us independent advice. Besides, he speaks excellent English, which is perfect for expats like me.

You will learn everything you need to know about insurance in Germany in the online seminar. If you want, you can also book a 1:1 meeting with my financial adviser to get a free personal consultation.

For more details regarding ALL types of insurance in Germany, check this out: Insurance in Germany – Which one do you need?

Cost of living: Tax costs in Germany

German has a high tax rate due to its strong social system. The income tax rate is progressive. It means that the more you earn, the more income tax you would have to pay.

Income tax rates for single persons in Germany for 2023

| Income (EUR) | Income Tax Rate 2022 |

| 0 – 10,908 | 0% |

| 10,908 – 62,810 | From 14% to 42% |

| 62,810 – 277,825 | 42% |

| Above 277,825 | 45% |

On top of the income tax, you may have to pay a church tax which is 8% or 9% of your income tax if you are a registered church member in Germany.

Before 2021, you will have to pay a solidarity tax of up to 5.5% on top of your income tax (if you pay more than 972 EUR taxes a year). The purpose of the solidarity tax is to help with the costs relating to German unification.

The good news is that starting 2021, the solidarity tax will be gone for 90% of the taxpayers. For 6.5% of the taxpayers, the solidarity tax will be reduced. Only 3.5% taxpayers will have to continue to pay the solidarity tax in full. Depending on your income, you may not need to pay solidarity tax any more in the future.

These taxes, together with the social security and pension costs, are deducted from your salary. Therefore, don’t be surprised if you only receive 60% of your gross salary in your bank account. You can use this unofficial tax calculator to have a feeling around how much tax you would need to pay based on your gross salary.

The tax rate is high. However, this also covers your pension, unemployment, health insurance, etc. Just need to always keep in mind the tax factor when you receive a job offer in Germany, as the money you get in the end will be less than what is stated in the contract.

How to save money?

- If you want to avoid the church tax, do not mention your church affiliation in any official documents (e.g. when you register your address in Germany). Check this out for more details: Church Tax in Germany – How to Stop Paying It?

- Filing a tax return can be very complicated, especially if you do not know the German language. An easier way would be to use some software so that you can do the German tax return by yourself in English. Check this out: 11 Best Tax Return Software Germany – Suitable for Anyone

- Even though the tax rate in Germany is high, there are many things you can claim as a tax return. You should keep all your paperwork and receipts for expenses as you may be able to claim taxes from them.

Also, make sure you take advantage of all the tax deduction. For example, if you are sending money to your family back home, these maintenance payments may be tax-deductible. I have saved thousands of Euros by claiming these expenses. Check out how I did it here: Maintenance payments (Unterhaltszahlungen) – How to deduct in your German tax return?

For more tips about tax return, check this out: Tax Return in Germany – Guide for Expats

Cost of Living: Buying a property in Germany

If you plan to buy a property in Germany, you should know that there can be a huge price difference depending on the location of the property. The real estate market is booming in major cities and the prices are increasing significantly compared to the last few years.

To give you an example, we bought a house five years ago with around 130 square meters for around 500k EUR. Now, the price of a newly built house right next to us is around 800k EUR with the same size. We are so glad that we already bought our house before. Otherwise, we wouldn’t be able to afford to buy a new one anymore.

According to Statista, below is the average price for a flat in some major cities in Germany in 2022.

| City | Euro per m² |

| Munich | 11,234 |

| Frankfurt | 7,983 |

| Stuttgart | 7,916 |

| Düsseldorf | 7,521 |

| Berlin | 7,424 |

| Potsdam | 7,378 |

| Hamburg | 7,271 |

| Rosenheim | 7,205 |

| Erlangen | 7,116 |

| Freiburg im Breisgau | 7,065 |

How to save money?

No matter if you want to buy a house in Germany for yourself or an investment property, the easiest way is to use the below free online mortgage calculator. Just enter the house price, your down payment amount, and some other basic info. You can then see the different mortgage options in minutes.

If you need to get a mortgage to buy your house, make sure to keep a good SCHUFA score. SCHUFA score is the credit score in Germany. A bad SCHUFA score can result in a higher mortgage interest rate for you.

For more information about buying a property in Germany, check out also

- Buying a House in Germany – As a Foreigner

- Mortgage in Germany – Pros & Cons of Each Type (Plus 6 Best Tips!)

- Real Estate Investment Germany – How I became a landlord

Cost of living: Renting a home in Germany

Rent contributes to the biggest part of your cost of living in Germany. If you are on a tight budget, you should aim at renting a flat with as low rent as possible. I know this is a difficult task to do. Especially in major cities in Germany, the rent has been increasing like crazy in recent years. And you actually have to be lucky enough to find a flat to rent. The supply of flats is way lower than the demand, making it unbelievably challenging for flat seekers.

Check out my tips below:

Rent deposit

When renting a flat, it is important to know that you should reserve more money than just the rent itself. Typically, you are required to pay for a deposit at the beginning of the rental, which can be around one to three months’ rent. You can get back this deposit if everything is fine when you return the flat in the future. If you make any damages in the flat, the landlord will deduct the damage cost from your deposit.

That is why it is good to have a personal liability insurance (Haftpflichtversicherung) in Germany, which covers the damage you cause to the properties of a third party. We recommend using Getsafe liability insurance because it offers English support and requires no paperwork. You can get 3 months for free now by using this special link.

For more about liability insurance, check out this post: Liability Insurance Germany – Expat Guide

A personal liability insurance may also increase your chance to find a flat as some landlords require their tenants to have this insurance. Check here to see which insurances you need in Germany.

Warm rent vs cold rent

Rent in Germany is divided into cold rent (Kaltmiete) and warm rent (Warmmiete). The cold rent is only the rent for the apartment without any utility costs. Warm rent is the total that you would need to pay, which includes utility costs like hot water, electricity or gas, heating, snow removal on the street, trash collection and any other cleaning services in the building, etc.

To give you some ideas, below is the average rental price per square meter from different cities in Germany. This data is extracted from Statista for the time period 2Q 2023.

|

City |

EUR per m² |

|

Munich |

20.7 |

|

Frankfurt am Main |

17.19 |

|

Berlin |

16.92 |

|

Freiburg |

16.12 |

|

Heidelberg |

15.84 |

|

Stuttgart |

15.77 |

|

Potsdam |

14.76 |

|

Mainz |

14.73 |

|

Köln |

14.56 |

|

Hamburg |

14.52 |

The rent in major cities has been increasing crazily year over year. So, you will probably find the rental price even higher if you are looking for accommodation now. Especially in major cities like Munich. Berlin used to have relatively cheap rental price compared to other major cities. However, the rent is catching up very fast in recent years and it is also not as cheap as in the past anymore. You can check out this website to look for the actual rental price in different cities at the moment.

How to save money?

As a rule of thumb, you should not be spending more than one-third of your income on rent. One way to get cheaper rent is to live farther away from the city center. For example, if you have to work or study in Munich, you may consider living in a small town outside Munich and commute to Munich when needed. You will need to compare the options you have, like how much rent you can save versus the additional transportation cost, in order to make the most economic decision. See also my post why I prefer to live in a small town vs a big city.

If you are a student, try your best to get a room in a student dormitory. Search in google “Studentenwerk” plus your city name. You should apply as soon as you can to grab a room. The price of a student dormitory is normally much cheaper than a private one.

Another option is to live in a shared flat with other people. Shared flats are very popular especially among students and are cheaper than if you would live on your own, which can bring down significantly your cost of living in Germany.

Read also: 42 Moving Tips – Moving Locally or Internationally

Cost of living: Utility costs in Germany

Water/ electricity/ heating, etc.

For most of the rental advertisements, the cold rent is listed. It means that on top of the cold rent, you also need to take into consideration the utility cost on top (like water, electricity, heating, etc.). If you rent an apartment, you can consider around 2.6 EUR per square meter on average for the utility costs.

An exception is when you rent a shared flat for a certain period. Sometimes you will only need to pay a warm rent which includes also the utility costs.

How to save money?

To save electricity costs, you should switch your electricity provider regularly. This can be done online within a few minutes and no structural change is needed in your home. You can save more than 100 Euros per year by doing so. Besides, don’t use the default electricity provider from your city. It is expensive.

For more details on how to do it, check out this post: Electricity in Germany – How to Save Money and Find the Best Provider

License fee for public service broadcasting

In Germany, every household has to pay a mandatory license fee for public service broadcasting called Rundfunkbeitrag. You must register with the GEZ (Gebühreneinzugszentrale) and pay 18.36 EUR per month.

Note that this price is per household. So, if you live in a flat with someone, you can share this cost together.

Internet, fixed phone line and television

Unless you live in a shared flat where the warm rent already includes internet services, normally you will have to take care of your own internet when you move into a flat. You can find a fast internet package with a fixed phone line at home which costs around 30 EUR per month. If you want to have a television connection as well at home, you will need to add a few Euros more. Click here to compare different internet, fixed phone line, or television package.

Mobile phone

If you live in Germany, it will be important to have a German phone number. Luckily, the mobile phone or SIM package is quite affordable nowadays. For example, you can find a package as cheap as a few Euros per month for 4 GB of mobile data and unlimited telephone minutes. Click here to compare different German mobile phone or SIM packages.

Read also: Best Mobile Operator in Germany – Compare the Top Plans

How to save money?

If you are on a very tight budget, you can choose to go SIM-only. It means that you only pay per minute or per MB used. This would make sense for someone who is not a heavy user.

In my case, I use a SIM-only option and I barely pay anything per month. I only use the internet at home or in the office, where I have WIFI. Note that in Germany, you only need to pay for the outgoing call. If you receive a call from someone, you do not have to pay.

If you already have an internet provider in Germany and are looking for saving more money, you can read my trick here about how we got a big discount from our existing internet provider.

Cost of living: Groceries in Germany

Compared to many other European countries, grocery shopping in Germany is not that expensive. You can do groceries shopping in supermarkets, farmers’ markets or even online. For a single person, 50 EUR per week should be enough for groceries and you can probably pay less if you are on a tight budget.

To give you an idea, below are the prices for some groceries in a big supermarket chain in Germany (Rewe) in Sept 2023. Note that the price will be cheaper if you shop at discount supermarkets instead.

| Food | Price € (kg) |

| Natural rice | 2.69 |

| Organic banana | 1.29 |

| Apple | 2.99 |

| Grapes | 4.49 |

| Orange | 1.99 |

| Carrot | 0.95 |

| Tomatoes | 1.29 |

| Mushroom | 6.8 |

| Pork neck | 11.9 |

| Beef mincemeat | 9.9 |

| Pork mincemeat | 7.98 |

| Turkey | 9.98 |

| Chicken | 6.99 |

| Organic dinkel toast | 5.31 |

How to save money?

Discount supermarkets like LIDL, NETTO, ALDI, and PENNY offer a lower price for groceries. You can also use a payback card to collect points and save money. For more details and other money-saving tips for grocery shopping, check out this: Supermarkets in Germany: What to expect and how to save money on groceries.

Cost of living: Eating out in Germany

In my hometown Hong Kong, people can afford eating out for every meal. So, many people may not know how to cook for themselves. If you plan to move to Germany, you better learn how to cook. It is not affordable to eat out for every meal. My cooking skills became better and better since I moved to Germany.

To give you some ideas, below are the average prices for eating out:

Of course, it will depend on the location and the restaurants in the end. You can find very cheap small restaurants, as well as super fancy and expensive restaurants. Note that tips are not included in the above prices. To learn more, check out this post: How much should you tip when eating out in Germany?

How to save money?

If you study at a university, there is usually a canteen called “Mensa” which is pretty cheap. If you work in a company, you may also have a canteen which provides meals at a lower price. Unlike in Hong Kong, where getting fast food like McDonald’s or others can be a cheap option, there is not a big price difference in Germany if you choose to get a meal from McDonald’s than from a small restaurant.

Cost of living: Transportation in Germany

Public transportation

If you live in a big city, there is usually a very good public transportation network. If you live in Germany for a longer time, it will make sense for you to get a monthly or yearly transport pass. With the pass, you can take different transportation means like buses, trains, trams, etc. The price of the pass depends on the zones you need. The more zones you need, the more expensive it is. So, if you live farther away from the city and need to commute to the city center regularly, you will need to pay more for the transport pass.

On average, you can expect to pay around 80 EUR per month for a monthly pass, or around 800 EUR per year for a yearly pass, depending on the zones you need. Different cities also have different prices. If you are in a city for a short period, you can either buy a one-way ticket or a day pass. A one-way ticket costs around 3 EUR, while a day pass costs around 15 EUR. Again, it depends on the zones you need and the city you are in.

Driving on your own

Driving in Germany is not very cheap due to all the costs of maintenance and insurance. If you plan to buy a car, check out this article to learn about the cost of buying and owning a car in Germany.

If you plan to lease a car, read this: Leasing a Car in Germany – How to Find the Best Deal?

You can also use these tips to save some money on your car insurance.

Besides, the fuel price is very expensive comparing to the US. For example, it costs 1.81 EUR and 1.95 EUR per liter for Diesel and Gasoline as of now (September 2023).

Moreover, parking is not cheap in the city center and it can cost 3 EUR per hour in major cities. For more details, check out this post: Driving in Germany – German driving license and driving rules.

Taxi

Comparing to my hometown Hong Kong, taking a taxi is not as common and it is much more expensive in Germany. Taxi tariffs start at 2.5 to 6.1 EUR, depending on the city. The cost per kilometer is around 1.6 to 3.2 EUR. People normally pay a small tip on top as well. With that said, a very short trip can easily cost more than 10 EUR.

Unlike in Hong Kong, people cannot just find a random taxi on the street easily in Germany. You will usually have to call the taxi service center in advance and they will arrange a taxi for you. An exception would be at the airport or main train stations, where you can find a taxi directly.

How to save money?

If you live close to your university or workplace and do not need to commute, biking is a good option. I used to live and work in a small town, where I only biked and never paid for any kind of public transportation. See this post about living in a big city vs. small town.

If you are under 27 years old, you can buy a Bahncard at a very low price which offers a great discount when you are traveling on the rail or with some buses. Check out more details here.

You can also travel in a group, or use car-sharing apps to save money. For all other tips regarding transportation and how to save money, check out my Germany Travel Tips: Getting Around.

Cost of living: Other expenses in Germany

On top of the basic needs, you may need to have other expenses from time to time like clothing, sport or entertainment. Normally I find it cheaper to buy clothing in big store chains. For example, you can get some normal clothing for around 20 EUR in big store chains like H&M, C&A, etc. For shoes, you can get a pair for around 30 EUR in a big store if you are not looking for some luxury brands.

If you want to join a gym membership, you can find a basic one that costs less than 45 EUR per month. For more premium chains, you can pay close to 100 EUR monthly.

Cinema tickets cost around 10 EUR. It is usually cheaper if you go during the day and not on the weekend. There is usually a student discount as well in the cinema. If you want to watch movies at home instead, you can find here different streaming platforms that are safe to use in Germany. It usually costs less than 10 Euros per month for a subscription.

If you want to be a bit more luxurious, you can hire a cleaner which costs around 15-20 EUR per hour. A babysitter will usually cost around the same price. It can be up to 20-25 EUR per hour if the babysitter is very qualified. You can search for a private cleaner, babysitter and other helpers here.

How to save money?

If you have a very tight budget (like me when I was a student), you can check out the flea market (Flohmarkt) for clothing or shoes. People sell their second-hand clothing, shoes, or anything you can think of in the flea market for a very low price. For example, when I was a student, I bought an autumn jacket for 3 EUR and a pair of summer shoes for 3 EUR only. Check for flea markets in your surroundings. They usually happen on the weekend.

Pin it for later:

How much is your cost of living in Germany? Do you have any tips on how to save money while living in Germany? Leave a comment below and let us know!

Moving to Germany or new in Germany? Check out our Resources Page for all the help you need!

If you found this article helpful, consider supporting this website by buying me a coffee. Every small donation helps to keep this blog alive. You can also ask me any questions here. Buy me a coffee

Do you know of any long term savings account one can open in Germany? If so, do you recommend savings or investing?

Most banks offer savings account. Regarding to savings or investing, I think it depends on how much you have. You should have enough savings to cover any unexpected expenses. If you have leftover after this buffer amount, investing is a good option in my opinion.

Such a great post!

Trank you very much! Very helpful tips) as soon as this corona crisis ends, would love to move to Berlin)

Thanks for reading! I am glad that you like it. I hope that the Corona crisis will end soon so that you can come to Berlin 🙂

Thank you so much, your information is very helpful. For us who lives in Africa wants to go abroad to fight for life

I am glad to hear that you like it 🙂

Yeah but i think i still need to know, that buy applying study visa should i know how to speak german language first? Or i can learn to speak when i reach there?

Do you mean are you required to know German? It depends on your country. For example, in some countries, in order to apply for a study visa, you need to prove that you already have German A1 level. For some other place like Hong Kong, I did not need to prove any German skill at all for my visa application. In general, I recommend anyone who is coming to Germany to learn German as much as possible. You will understand the frustration once you live in Germany if you do not speak German.

Sorry i wrote buy instead of by in the above comment.

Okay, thank you so much for this information it has been great to learn so much from your site. Stay Blessed

One last thing, you know i live in East Africa in a country called Tanzania some of young Tanzanians are desperate to travel abroad to fight for life in euro because here life is so hard, so can i ask for your personal contacts if you wont mind so i could easly contact you instead of writting so much in this page?

Totally understandable that many people want to move abroad for better living standard. You can contact me here: [email protected]

Okay thank you